Swindon: Teen Killer Named as He Turns 18

Swindon Teen Revealed in Fatal Stabbing Ciaran Newman, the teenage boy who stabbed Owen Dunn through the heart, has been named for the first time. The 18-year-old’s identity was previously shielded

Driver Jailed for Fatal Head-On Crash After Dangerous Overtake

Danielle Barrett, 28, has been jailed for six years after causing a fatal crash on the B1192 near Coningsby last July. The reckless driver overtook dangerously on a bend and collided head-on

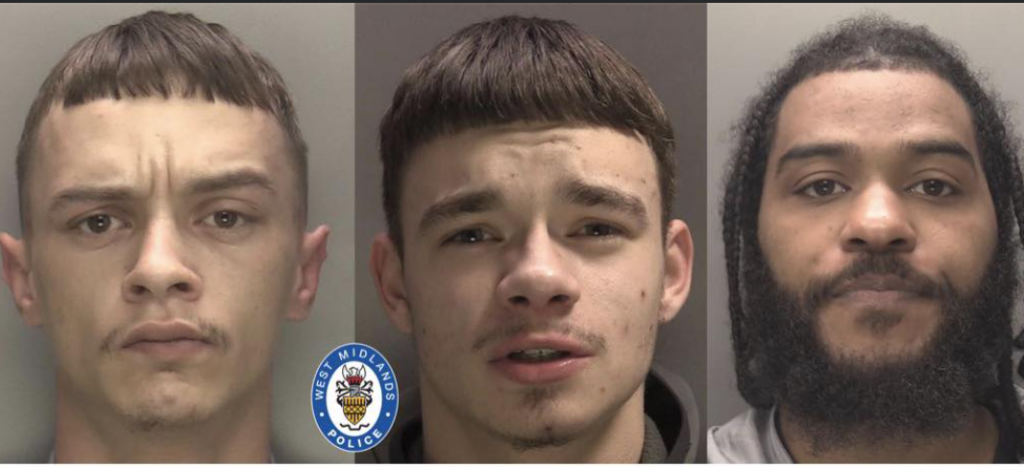

Three Men Locked Up Over £2 Million Car-Key Burglary Spree in Birmingham

Three men have been jailed for a massive car-key burglary racket across Birmingham, with thefts valued at nearly £2 million. The gang hit over 100 times, stealing high-end cars using cunning methods.

Crewe Drug Dealer Snared After Raking In Over £500k — Jailed for Seven Years

Lee James Locked Up for Peddling Cocaine and Cannabis Lee James, 39, from Shavington, has been slammed with a seven-year prison sentence for dealing Class A and B drugs in Crewe. The

Public Tips Lead to Drug Dealer’s Jail in South Woodham Ferrers

A 21-year-old drug dealer was locked up after locals reported his shady activities to the police in South Woodham Ferrers, a court heard this week. Vison Tahiaraj Slapped with Jail for Cocaine

Two Men Jailed Over Class A Drugs Bust in Sheffield

Two Sheffield men have been locked up for over a decade combined after police caught them with large quantities of Class A drugs, cash, and multiple phones. Officers Spot Suspicious Vehicle on

Coronation: Man Locked Up for Manslaughter After Deadly Punch-Up in Chatham Car Park

A man has been jailed for manslaughter after two brutal punches in a Chatham car park led to a man’s untimely death. Unprovoked Attack in Magpie Hall Road Car Park John Farmer,

Dangerous Driver Jailed After High-Speed Crash in Darlington

Carl Hollywood has been locked up for 18 months after crashing a stolen car into stationary traffic in Darlington. The 36-year-old’s wild ride put lives at risk before the smash brought him

Four Convicted Over Organised Crime Arson Spree

Blazing Crimes in Edinburgh and Stepps Four men have been convicted following a spree of deliberate vehicle and property fires linked to serious organised crime. Kieran Abercrombie, 32, Kenzie Gardner, 19,

Hertford Man Locked Up for Brutal Stabbing in Thundridge

A 22-year-old man has been jailed for nearly five years after stabbing a man twice during a terrifying attack in Thundridge. Samuel Clarke Sentenced at St Albans Crown Court Samuel Clarke, from

Wakefield: UK: Second Prisoner Denies Murdering Ian Watkins in Jail

Another inmate has pleaded not guilty to killing disgraced Lostprophets singer Ian Watkins behind bars. Watkins Stabbed to Death in Maximum-Security Prison Ian Watkins, 48, died after a brutal attack last

Norwich: Drone Daredevil Lands Fine After Flying Over Emergency Services

First Conviction for Flying Over an Emergency Response Christopher McEwen, 46, from Norwich, has been slammed with a £2,000 fine for a string of dangerous drone offences – including flying over an

Worth: UK: Lord Alli Named in Epstein Files: Labour’s Dark Money Web Exposed

Shockwaves hit Labour as Lord Alli, one of the party’s biggest donors, surfaces in the newly released Epstein files. Just how tangled is Starmer’s party in this scandal? Starmer Faces Fiery Questions

Hampshire: Gmail Users Beware: Scary ‘Subpoena’ Email Scam Strikes Hard

Heads up, Gmail fans! A nasty phishing scam is flooding inboxes with fake “subpoena” emails demanding access to your account. Don’t buy it – this is a con designed to nick your

London: Met Police Urged to Scrap Facial Recognition Tech

Assembly Member Blasts Live Facial Recognition Over Civil Liberty Fears The Met Police have been told to immediately stop using Live Facial Recognition (LFR) technology until proper safeguards and rules are put

Man Stabbed in Early Morning Attack on Evelyn Walk

Knife Incident Rocks N1 at 2:30 AM Just after 2:30am on Friday, 13 February, police rushed to Evelyn Walk, N1, after reports of a violent altercation. Victim Found with Stab Wounds

Man Who Tried to Kill Army Officer in Chatham Knife Attack Jailed for Life

Life Sentence for Vicious Stabbing Near Barracks A 25-year-old man who repeatedly stabbed a uniformed army officer outside Brompton Barracks in Chatham has been sentenced to life in prison, with a minimum

Two Men Locked Up Over Massive Clydebank Cannabis Farm

£300k Cannabis Crop Raided in Industrial Unit Police struck gold at 1.50am on Friday, 1 May 2020, when they busted a massive cannabis farm hidden inside an industrial unit on Glasgow