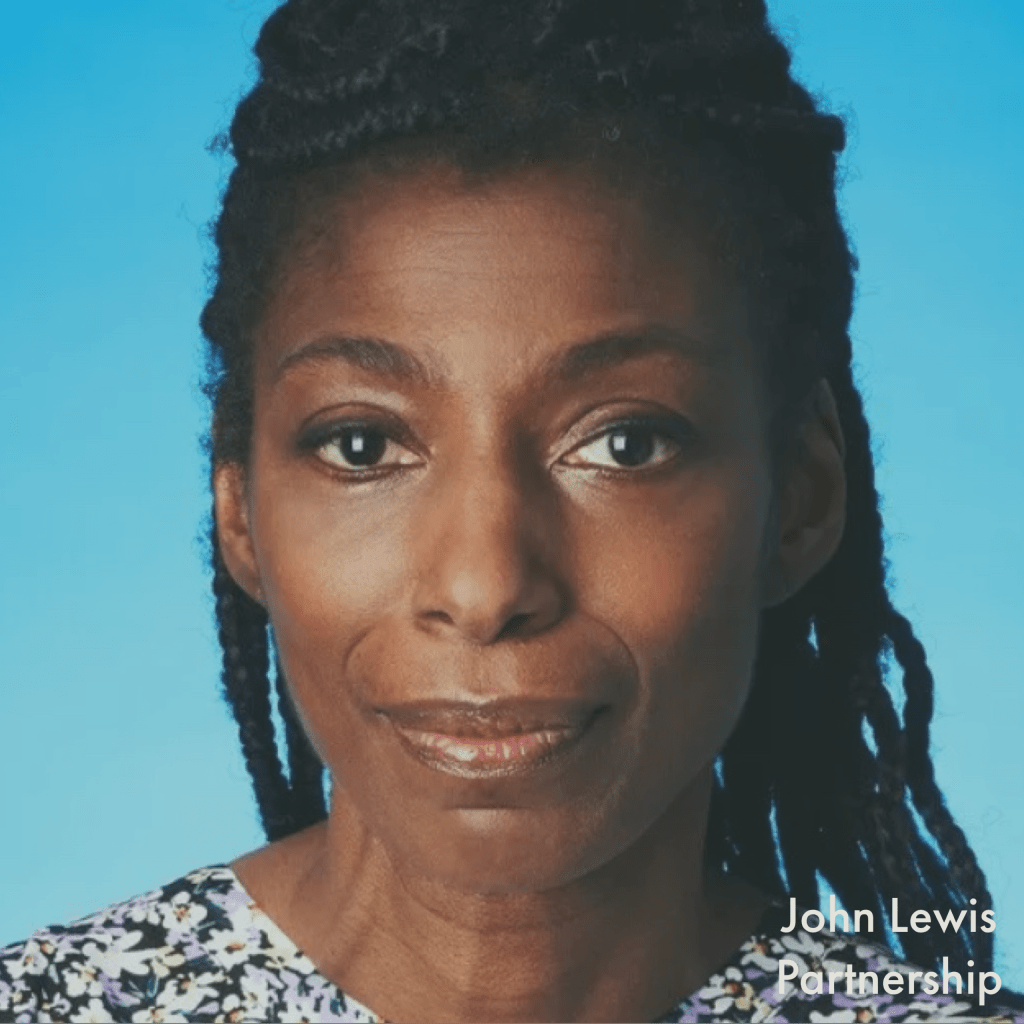

In a surprising development, Dame Sharon White, the current chair of John Lewis, is set to step down after a five-year term, becoming the shortest-serving chair in the partnership’s near 100-year history. Dame Sharon conveyed to the board that she will not seek a second term, and her tenure will conclude in February 2025. The departure comes in the wake of the partnership reporting a substantial loss of £234 million last year, leading to the cancellation of the annual staff bonus.

Dame Sharon White acknowledged the financial challenges faced by the partnership but mentioned that the chain is “making progress” in its ongoing transformation. Despite expressing optimism, she admitted that there is a “long road ahead.” Her five-year term as chair will notably be the shortest in John Lewis’s history, a departure from the lengthier tenures of her predecessors, who each served between 13 and 26 years.

Shift in Home Buyer Trends Amid Affordability Concerns

As affordability concerns grip the housing market, surveys indicate a shift in home buyer behavior. A quarter of mortgage holders under 30, who initiated their loans early this year, are opting for a 35-year term, according to credit reference agency Experian. This marks a significant increase from 10% in January 2020. Nationwide Building Society’s report reveals a 5.3% decrease in average property values compared to a year ago, prompting buyers to consider smaller properties and longer-term mortgages.

TSB Announces Mortgage Rate Cuts in Ongoing Lender Competition

TSB has joined the ranks of lenders reducing mortgage rates, with rates starting from 4.89%, a move seen as a response to heightened competition for borrowers’ business. The bank’s rate cuts extend to various mortgage products, including a five-year fixed 0-60% LTV mortgage for movers and first-time buyers starting at 4.89%. Brokers welcome the rate reductions, emphasising the continued competition among lenders despite concerns of a potential slowdown.