It wasn’t that long ago that cash and chip-and-pin ruled the tills in the UK. But fast forward to today, and your phone is the new wallet. From grabbing a morning latte to sending a quick tenner to a mate, digital wallets are fast becoming the go-to payment method for millions across the UK.

Platforms like Apple Pay, Google Pay, and Samsung Pay are leading the charge, offering quick, contactless, and secure transactions, and Brits are buying in—big time!

Digital Wallets are Now a Lifestyle

There’s no denying it – digital wallets are taking over. Whether it’s tapping a phone at the corner shop or managing subscriptions on the move, this tech is making money matters easier than ever.

Younger users are especially on board, drawn by the ease, speed, and security. A single app can now store everything, from debit and credit cards, loyalty schemes, even rail passes. It equates to convenience in your pocket, and it’s pushing us ever closer to a cashless society.

As card use declines and paper money becomes rarer on the high street, digital wallets are filling the gap – and then some.

The Crypto Crossover

But it doesn’t stop there. Enter: cryptocurrency.

What once felt like a buzzword is now a real player in UK payments. From Bitcoin to Ethereum, crypto is making its way into daily transactions, and not just among tech enthusiasts.

Online industries have been the first to adapt. eCommerce, gaming, and online gambling sites 2025 has to offer are already welcoming crypto payments. These help offer customers faster, secure, and often anonymous ways to pay—amid existing perks like expansive gaming libraries and generous bonuses.

This shift is transforming everything and wallets like PayPal and Revolut are responding. Users can now toggle between pounds and crypto with ease, managing their finances in one sleek dashboard. Shopping, sending money, or placing a bet, it’s all quicker and smarter.

Why Crypto in Wallets Makes Sense

Adding cryptocurrency to digital wallets is becoming a smart move for everyday users across the UK. It offers lower transaction fees, quicker international transfers, and greater access to financial tools, all within a single, easy-to-use platform. Whether you’re a freelancer dealing with global clients or simply looking for more control over your money, crypto brings speed and flexibility to the table.

And, it’s no longer just tech enthusiasts taking advantage. With growing mainstream adoption and user-friendly apps, more people are now exploring crypto as a practical part of their daily finances, opening doors to a broader, more modern financial world.

Small Businesses Reaping Big Rewards

It’s not just consumers seeing the upside. Small businesses and entrepreneurs are also cashing in on the digital wallet boom. With lower transaction fees and the ability to accept multiple payment types, including crypto, UK businesses can stay nimble and competitive.

From local cafes to online startups, adopting digital wallets helps streamline operations and boost customer convenience. Crypto acceptance also opens doors to global markets, offering new income streams and a modern edge.

Regulation Catching Up With the Tech

Of course, with new tech comes new risks, and regulation is racing to keep up. The UK government is already laying the groundwork for tighter controls, especially around fraud prevention, money laundering, and crypto volatility. It’s a delicate balancing act, protecting consumers while still encouraging innovation.

Financial institutions are now working closely with regulators to ensure these tools are safe, secure, and trustworthy for both businesses and the public.

Safety First

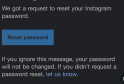

Security remains front and centre. With more Brits trusting digital wallets to handle their money, providers are beefing up defences. Expect to see more multi-factor authentication, biometric logins, and the use of blockchain technology to fend off fraud.

But cyber threats are evolving, and the fight is far from over. Ongoing vigilance and investment in cybersecurity are vital to maintain public confidence and keep the digital wallet revolution on track.

The Road Ahead

Looking to the future, digital wallets are only getting better. With tech like AI, biometrics, and multi-currency support on the rise, wallets will soon be smarter, faster, and even more integrated into daily life.

For consumers, that means safer spending and smarter money management. For businesses, it’s all about efficiency and lower costs.

Conclusion

Digital wallets aren’t just convenient anymore, they’re essential. As cryptocurrencies find a solid footing in the UK financial scene, they’re becoming central to how we pay, save, and invest. The blend of traditional and digital finance is opening doors for more people and businesses than ever before.

Whether you’re tapping to pay at the pub, transferring crypto to a friend, or running a side hustle, the future of money is already here.