Data and numbers

The global gaming industry is no stranger to growth. What once looked like a niche market is now one of the largest digital economies. Players, and also investors, and platforms alike are paying attention because the numbers tell a compelling story. Opportunities keep expanding, and revenue projections continue to break records. For readers who engage actively with platforms and digital services, it is simple to get started — some users choose to sign up at 1xbet OM, because platforms invest heavily in user experience as part of this wider financial movement.

Numbers reveal more than just turnover. They highlight where player demand grows, how mobile access changes habits, and why revenue forecasts matter. This article provides data, context, and insights into the financial side of gaming without the fluff.

Revenue trends in the global market

Forecasts across industry analysts point in one direction — up. Market research firms project gaming revenues to pass the $300 billion mark by 2030 year. Mobile usage, and also stronger internet connections, and subscription-based services fuel this trend.

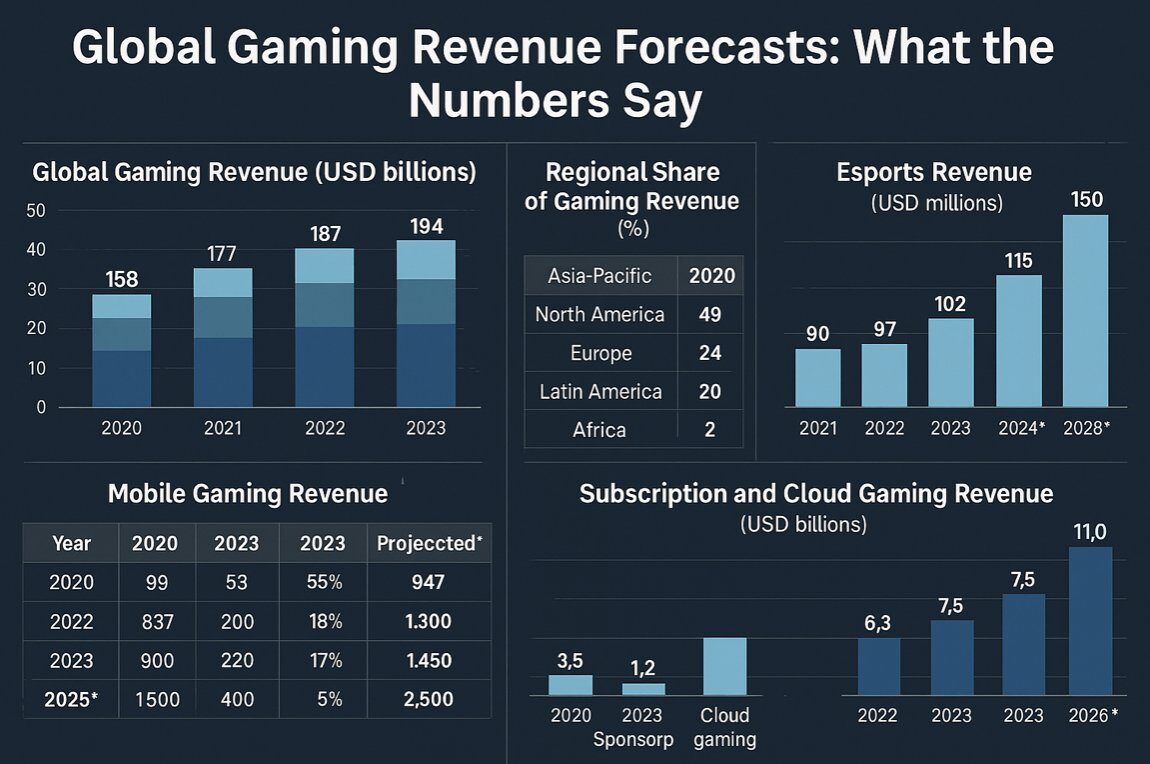

Global gaming revenue (USD billions)

|

Year |

Mobile |

Console |

PC |

Total |

|

2020 |

77 |

45 |

36 |

158 |

|

2021 |

90 |

49 |

38 |

177 |

|

2022 |

97 |

51 |

39 |

187 |

|

2023 |

102 |

52 |

40 |

194 |

Where growth comes from

Mobile devices explain much of the success. Subscription services on phones and handhelds deliver easy access. Players spend small amounts more frequently, which adds up quickly in revenue forecasts.

Regional share of gaming revenue (%)

|

Region |

2020 |

2023 |

Projected 2026 |

|

Asia-Pacific |

49 |

53 |

55 |

|

North America |

24 |

22 |

21 |

|

Europe |

20 |

18 |

17 |

|

Latin America |

5 |

5 |

5 |

|

Africa |

2 |

2 |

3 |

Forecasts for mobile-driven revenues

The growth links directly to smartphone penetration. Over 6.9 billion smartphones are active worldwide in 2024, and it makes mobile access nearly universal.

Mobile gaming revenue (USD billions)

|

Year |

Revenue |

|

2021 |

90 |

|

2022 |

97 |

|

2023 |

102 |

|

2024* |

115 |

|

2028* |

150 |

*Forecast

Factors shaping future revenues

Several factors explain why forecasts keep climbing. Analysts cite both consumer and structural drivers.

- Higher smartphone usage and lower mobile data costs.

- Growth of subscription platforms and cloud services.

- Expansion of cross-platform titles.

- Increased digital payments penetration.

- Esports driving sponsorship and streaming revenues.

Each factor adds momentum to projections. Together, they form a solid foundation for revenue forecasts across continents.

Streaming and esports influence

Esports revenue (USD millions)

|

Year |

Sponsorship |

Media rights |

Merchandise |

Total |

|

2020 |

584 |

163 |

107 |

947 |

|

2022 |

837 |

200 |

120 |

1,300 |

|

2023 |

900 |

220 |

130 |

1,450 |

|

2025* |

1,500 |

400 |

200 |

2,500 |

*Forecast

Impact of subscriptions and cloud gaming

Subscription-based services change the spending pattern. Instead of paying per title, players pay monthly for access to libraries. This provides stable recurring revenue streams for providers.

Cloud gaming also pushes forecasts forward. With cloud, players stream games without high-end devices.

Subscription and cloud gaming revenues (USD billions)

|

Year |

Subscription |

Cloud gaming |

|

2020 |

3.5 |

1.2 |

|

2022 |

6.3 |

3.0 |

|

2023 |

7.5 |

4.2 |

|

2026* |

11.0 |

8.2 |

*Forecast

Closing outlook

Forecasts reveal that gaming revenues will not slow down anytime soon. Mobile drives the bulk, streaming adds momentum, and subscriptions secure stability. Investors and platforms prepare for new peaks as billions flow into this space.

Players benefit from broader access and stronger platforms. Markets worldwide become part of one connected ecosystem, where growth is measured in billions.

The message is clear: numbers are not just statistics — they are signals of where global entertainment moves next.